Hilary Calvert is an ex-Lawyer, ex-MP and ex-City Councillor and Regional Councillor..

The email line the ODT left out was my main reason for asking questions of the DCC CEO.

“Looking at some local instances of the very young, some pre-teens now wanting sex-change surgery and hormones has made some parents I know extremely concerned.”

I am paid to ask questions of the DCC on behalf of Dunedin citizens, and I will continue to do so as long as I continue to have strong voter support.

Tonight my speech to an almost full crowd at the Northern Oaks Alhambra Club rooms included the following:

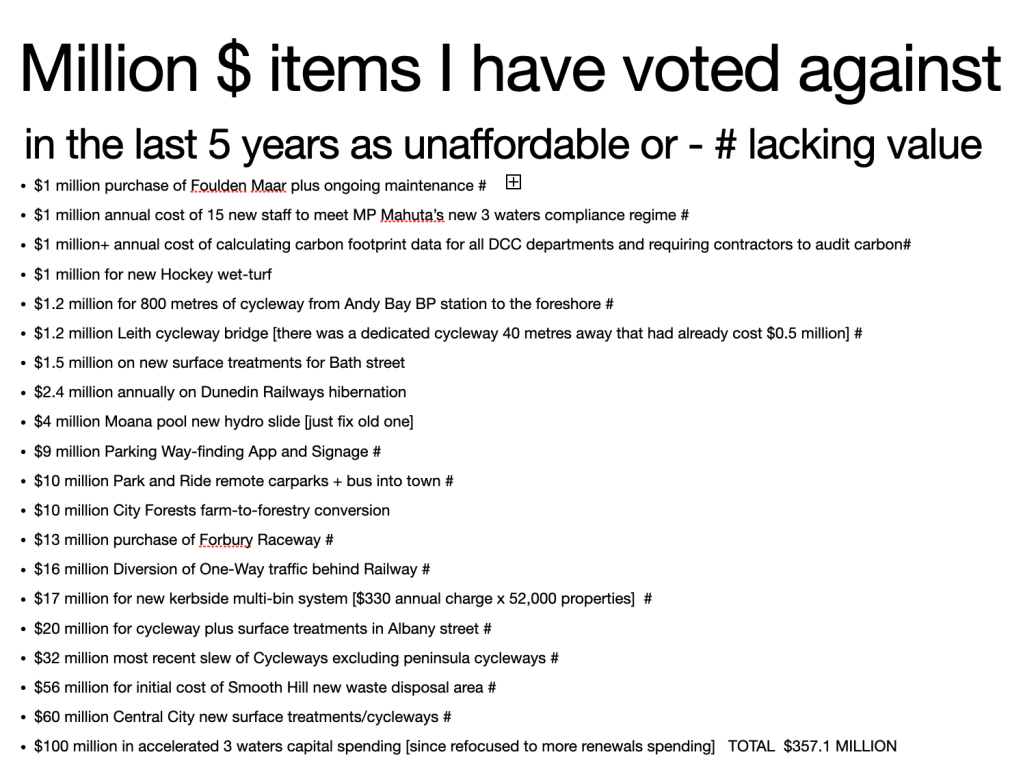

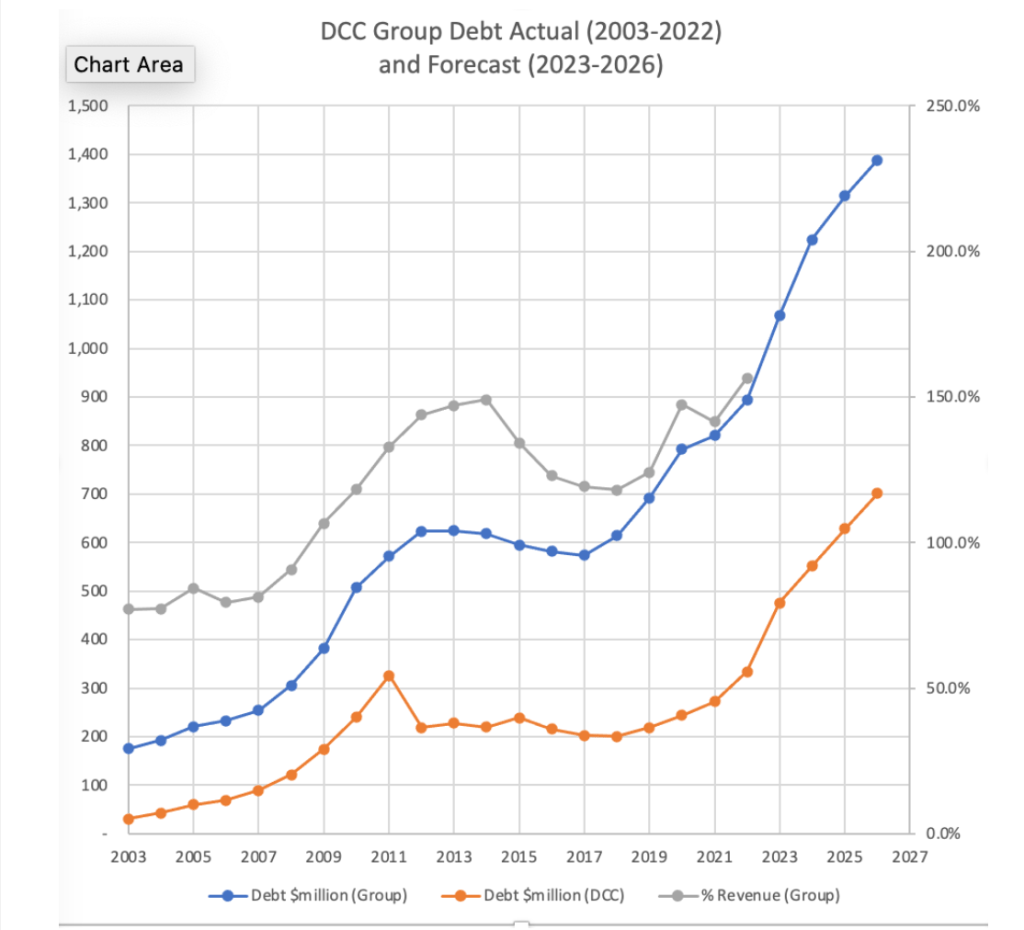

I voted against raising the debt cap from $1.2 BILLION TO $1.6 Billion last year, but indications are that even that may not be enough in two years time if we don’t sell Aurora.

tomorrow Friday 7pm at Northern Oaks Alhambra Club rooms that that will be covered by media this time.

Look sideways for details…

That depends how much extra is borrowed to kick the can further down the road…

https://www.youtube.com/live/OZIKjTTQ6Aw…

DCC spending has long been out of control and often poor value in my view.

Read on blog or Reader |

“Town Hall may need scaffolding for years | Otago Daily Times Online News (odt.co.nz)

Construction hoardings and scaffolding around Dunedin’s town hall complex could be in place for more than five years while remediation work is carried out.”

The Municipal Chambers only took 2 years for the entire build.

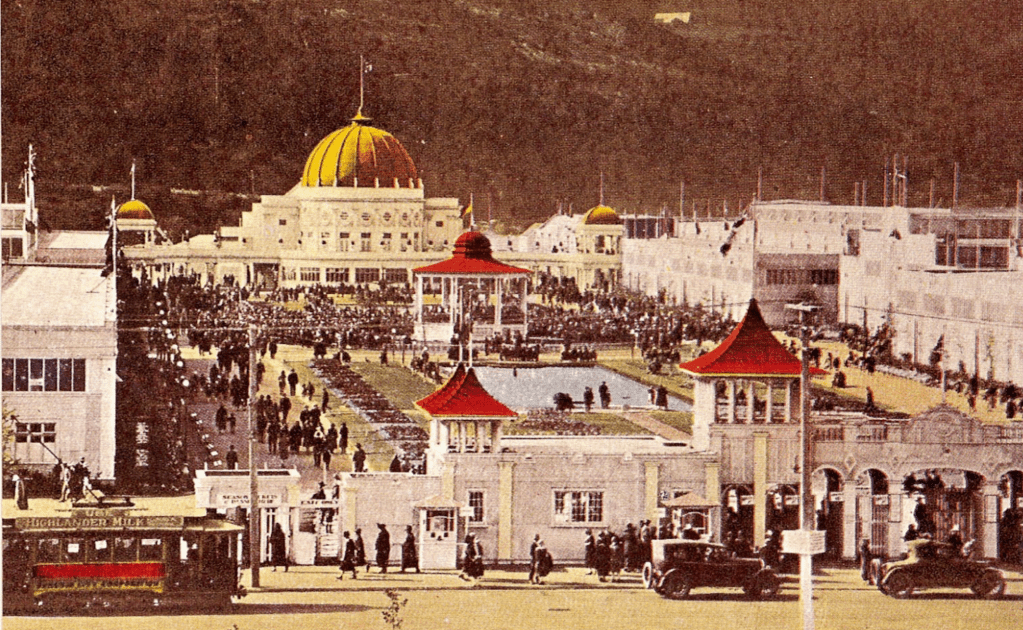

The Town Hall itself took less than 2 years to build, foundation stone 3 March 1928 – opened 15th Feb 1930 and was built without any debt!

From Wikipedia “The City Council’s profits from its trading departments during the 1925-1926 South Seas Exhibition enabled it to undertake the project and pay for it with cash”

Finally we now have a proposal to get a return from this long dysfunctional public investment.

ODT 14/03/2024 “In 2021, Cr Lee Vandervis argued the council should consider selling some of its companies, including Aurora Energy. Cr Vandervis suggested the council allow another party to run the companies “properly, because we have failed”.

Full ODT front page story is published behind a paywall so I can not provide a public link.

Rates

32 The draft operating budget for 2024/25 shows overall rates revenue increasing by $35.588 million, which is 17.5% higher than 2023/24. It is also higher than the rate increase of 6.0% provided for in the 10 year plan.

There is also an increase in debt of $117.554 million on the 2023/24 Annual Plan which temporarily avoids a much higher rates increase of near 35% and gives the DCC another unbalanced budget.

CEO Overview Report – Annual Plan 2024/25

Department: Civic and Finance

EXECUTIVE SUMMARY

1 On 16 February 2024, the Water Services Act Repeal Act 2024 (the Repeal Act) was enacted. Given the significant changes to 3 Water reform, the Repeal Act provides the ability to prepare an enhanced Annual Plan for the 2024/25 year, rather than completing a 10 year plan 2024-34.

3 This report provides an overview of the budgets to be included in the draft 2024/25 Annual Plan (the draft Annual Plan). The draft Annual Plan is an update of year four of the 10 year plan 2021-31. Draft Income Statements are at Attachment A, and draft Funding Impact Statements are at Attachment B.

4 This report highlights the budget challenges the DCC faces with the current economic climate of high inflation and interest rates. Savings have been found across the organisation, but these have largely been offset by rising costs.

5 The draft budgets propose a rate rise of 17.5% for 2024/25 which is higher than the 6.0% provided for in year four of the 10 year plan, and higher than the Financial Strategy rate limit of 6.5%.

6 Budgeted staffing numbers have reduced from 903 FTE to 852 FTE – a reduction in 51 FTE positions. All other controllable costs have been reviewed and reduced where possible.

That the Council:

a) Adopts the draft 2024/25 operating budgets for the purpose of community engagement as shown / amended at Attachment A.

b) Notes that any resolution made during this meeting relating to the 2024/25 Annual Plan reports may be subject to further discussions and decision by the meeting.

BACKGROUND

7 Following the enactment of the Repeal Act on 16 February 2024, at its meeting on 27 February, Council approved taking up the option of preparing an enhanced 2024/25 Annual Plan for community consultation, rather than preparing a 10 year plan 2024-34.

8 This decision was made following consideration of factors such as the changing legislative environment (both recent and signalled), and our need for more information that will allow us to prepare a more robust and informed 9 year plan.

9 The Local Government Act 2002 provides that Council must prepare and adopt an annual plan for each financial year. Section 95 (5) sets out the purpose of an annual plan as follows:

The purpose of an annual plan is to –

(a) Contain the proposed annual budget and funding impact statement for the year to which the annual plan relates; and

(b) Identify any variation from the financial statements and funding impact statement included in the local authority’s long-term plan in respect of the year; and

(c) Provide integrated decision making and co-ordination of the resources of the local authority; and

(d) Contribute to the accountability of the local authority to the community.

10 The Repeal Act provides that an enhanced Annual Plan is to include information additional to the Local Government Act requirements. The additional information includes financial statements and statement of service performance information for each group activity. This information will be included in the 2024/25 Annual Plan document adopted in June 2024.

11 The draft Annual Plan for 2024/25 is an update of year four of the 10 year plan. Budgets for the 2024/25 year have been reviewed and budget update reports for each activity of Council have been prepared for consideration at this meeting.

DISCUSSION

13 We continue to have the pressures of high inflation rates, increased interest costs – both rate increases combined with increasing debt levels, and the impact of asset revaluation on our depreciation costs. Interest is estimated to be up $6.1 million (23.3% on 2023/24), and depreciation by $5.2 million.

14 Many of the cost increases we are experiencing are outside of the control of Council, e.g., increased energy costs to run our pools and other facilities, insurance costs, and new costs such as compliance monitoring to meet water quality standards.

15 A rate increase of 17.5% is proposed in the draft budgets. This increase in rates will maintain current service levels but also pay for an increased level of service for a new kerbside collection service. This new service, commencing in July 2024, replaces the black rubbish bag system. Of the 17.5% rate increase, 4.4% will cover the cost of this new service.

Significant forecasting assumptions

16 The 10 year plan sets out a number of Significant Forecasting Assumptions. Assumptions relating to inflation and interest rates have been updated for the draft budgets.

17 Key assumptions included in the preparation of the draft budgets will be further updated in May 2024 if required. This will include but not be limited to:

· Interest rates on borrowing – including the allocation of interest costs to each activity group.

· Forecast debt as at 30 June 2025.

· The impacts of inflation.

· The level of grant funding from NZTA Waka Kotahi (if available).

Rates breakdown at a high level

18 The summary below provides a breakdown of the main factors making up the rate increase:

3 Waters 5.4%

Increase in depreciation (excl. 3 waters) 4.9%

New kerbside collection service 4.4%

Interest (excl. 3 waters) 1.8%

All other costs 1.0%

Total rate increase 17.5%

19 The breakdown is relatively simplistic and does not take into account the impact of increases in other revenue but does highlight the three main drivers of the rates increase. Broadly this shows that costs have been absorb where they can be, and savings found in an attempt to control discretionary expenditure. Fees and charges have been reviewed more critically, and rather than apply a blanket increase across these, many have been modified to reflect the actual cost of the services provided.

20 The increase in 3 Waters includes increased regulation and compliance costs to meet water quality standards, such as for chemicals and laboratory testing.

21 The increase in depreciation reflects the revaluation of some assets and the budgeted capital programme.

22 The Kerbside collection rates are for the new service starting in July 2024, replacing the current black bag system.

Capital expenditure

23 The draft capital budget for the Annual Plan provides for replacing existing assets and infrastructure. Across the Council’s activities, the proposed budget is $207.357 million in the 2024/25 year, compared to $157.044 million provided for in year four of the 10 year plan.

24 One area of uncertainty is the amount of co-funding that may be received from NZTA Waka Kotahi for budgeted transport activities. The draft Government Policy Statement on land transport 2024-34 has now been released for consultation purposes. It sets out the Government’s priorities for land transport investment. Staff are reviewing the draft Statement to understand the impacts it may have on our assumptions around co-funding for transport initiatives. Our findings will be reported to Council before finalising the Annual Plan.

Operating budgets

25 The draft operating budgets provide for the day to day running of all the activities and services the DCC provides to its community. These include 3 Waters services, parks, galleries, libraries, pool, and roading.

26 The rate increase of 17.5% included in the draft budget does not deliver a balanced budget, but provides for a net deficit of $25.655 million.

27 The revaluation of three waters infrastructure assets in 2022/23 resulted in a significant increase in depreciation. Since this time, the depreciation charge has not been fully funded, and Council has been running an operating deficit budget.

28 As part of the development of the 9 year plan 2025-34, a financial strategy will be prepared that addresses the issue of ongoing deficits, and provide for balancing the budget before the end of the 9 year plan.

29 Expenses within our control have been reviewed and the operating budgets show that savings have been made in many of the group activities.

30 The biggest area of increase in operating budgets is in the Waste Management activity. This significant increase in operating budget is primarily due to new contracts for the new kerbside collection service and monitoring costs required in the consent for the new Smooth Hill Landfill.

31 Each of the groups of activities have updated year 4 of their draft operating budgets as provided for in the 10 year plan. The key changes in funding sources and expected costs of delivery are discussed in the group operating budget reports.

Revenue

Rates

32 The draft operating budget for 2024/25 shows overall rates revenue increasing by $35.588 million, which is 17.5% higher than 2023/24. It is also higher than the rate increase of 6.0% provided for in the 10 year plan.

External revenue

33 External revenue has increased by $5.405 million, 5.9%. The main changes to external revenue are:

· Waste Management – a net increase of $2.553 million reflecting an increase in landfill revenue due to an expected increase in tonnage because of the closure of a transfer station and an increase in landfill disposal charges to cover expected increases in waste levy and ETS charges. Offsetting these increases, revenue from the sale of black rubbish bags ceases.

· Property – an increase of $877k due primarily to an increase in community housing rental.

· 3 Waters – an increase of $647k due to increases in fees and charges, including water sales and trade waste.

· Regulatory – an increase of $499k in fees to recover increased costs of processing consents and licenses.

34 Fees and charges are discussed separately in the group budget reports. Rather than apply a fee increase of 3%, as has been done in past years, fee increases for some areas are reflecting the increase in costs from the 2023/24 year.

Grants

35 Grant funding received from NZTA Waka Kotahi for transport activities is based on the nature of the planned capital works, and their eligibility for funding. It is also dependent on how much funding assistance is available, noting that there has been a shortfall in the Funding Assistant Rate in recent years.

36 The 2024/25 draft budget shows operating grants and subsidies revenue is down $2.499 million. The main changes are as follows:

· 3 Waters – operating grant funding has decrease by $4.400 million. The Transition Support Package funded by the former Government, set up to contribute towards transitioning to the now repealed Water Services Entities has been discontinued. In addition, Government funding for the 3 Waters Strategic Work Programme has been replaced by Better off Funding.

· Governance – operating grant funding has increased by $2.559 million, being the Government’s Better Off Funding package. This funding is being used for various projects across Council.

37 Capital grants revenue is down $3.697 million. The main changes are as follows:

· Waste – capital grant revenue has decreased by $670k. In 2023/24 grant funding was provided from the Ministry for the Environment for the purchase of bins.

· Transport – capital grant revenue has decreased by $3.067 million, based on the proposed capital programme and estimated funding assistance from NZTA Waka Kotahi.

Expenditure

Staff costs

38 The draft budget provides for an increase in personnel costs of $2.667 million, 3.3%. This provides for a union negotiated salary increase for staff.

39 The 2023/24 budget did not provide for a salary increase, and the negotiated increase was absorbed within existing budgets.

40 This saving has been achieved by vacancy management and a slow-down in recruitment. Vacancy management and a thorough review of budgets has resulted in the budgeted headcount reducing from 903 FTE to 852 FTE – a reduction in 51 FTE positions. Management of vacancies continues to be a priority, along with careful recruitment and looking after existing staff.

Operations and maintenance costs

41 Operations and maintenance costs have increased by $12.706 million, 16.5%. The main changes are due to the following:

· Waste management – an increase of $10.158 million relates primarily to the new kerbside collection service, increases in ETS costs and Green Island landfill costs, and additional monitoring for Smooth Hill and the implementation of the Southern Black Back Gull management plan, both required under the resource consent.

· 3 Waters – an increase of $2.311 million relates to plant maintenance cost increases, chemical and laboratory cost increases. There is a reduction in contractor fees, as government funding for the 3 Waters Strategic Work Programme ends.

· Transport – an increase of $737k, with $486k relating to costal management work, and $234k for an increase in bus shelters (fully recoverable from the Otago Regional Council) and State Highway maintenance (fully recoverable from NZTA Waka Kotahi).

· Parks, Galleries Libraries and Museums, Community and Planning, Property, and Economic Development have all made savings in their operations and maintenance costs. Further details are provided in each of the group budget reports.

Occupancy costs

42 Occupancy and property related costs such as rates, insurance and fuel have increased by $3.150 million, 9.7%. These increases have largely impacted the Property activity with an increase of $1.780 million and 3 Waters with an increase of $1.005 million.

Consumables and general costs

43 Consumables and general costs have increased by $1.822 million. The main changes are due to the following:

· Waste Management – an increase of $870k due to an increase in waste levy costs at the Green Island landfill, reflecting an increased tonnage in materials entering the landfill, offset by a reduction in costs relating to communications and marketing of the new kerbside collection service.

· Governance – an increase of $970k largely due to increases in software licencing fees of $743k.

Depreciation

44 Depreciation expense has increased by $5.215 million, 4.5%, reflecting the valuation of assets at 30 June 2023 and the capital expenditure programme. The increase is reflected mainly in the Transport, 3 Waters, Property, and Parks and Recreation activities.

Interest

45 Interest expense has increased by $6.118 million, 23.3%, reflecting the increase in debt funding required to support the planned capital expenditure programme and an increase in interest rates.

46 The 10 year plan 2021-31 had an interest rate assumption of 2.85%. The DCC’s current interest rate applicable to its borrowing is 4.66% as advised by Dunedin City Treasury Limited. For the purposes of preparing the draft Annual Plan, an assumption has been made that the borrowing rate for the 2024/25 year will be 5%.

Funding impact statement

47 The budget for each group, and all of Council, includes a Funding Impact Statement, as provided at Attachment B. Funding Impact Statements differ from Income Statements because they:

· Remove non-cash items such as depreciation,

· Separate operating and capital funding

· Include how total funding will be used, i.e., capital expenditure

· Identify how any shortfall in funding will be financed, i.e., an increase in debt.

48 Ideally the available operating funding being “Surplus/(deficit) of operating funding (A-B)” plus “Subsidies and grants for renewal expenditure” will be sufficient to cover capital expenditure “to replace existing assets”.

| Funding Impact Summary | Budget 2023/24 $000 | Draft Budget 2024/25 $000 |

| Surplus/(deficit) of operating funding (A-B) | 59,579 | 71,707 |

| Subsidies & grants for renewals expenditure | 8,012 | 11,840 |

| Capex to replace existing assets | (138,077) | (101,139) |

| Increase in investment DCHL | (2,550) | (2,550) |

| Funding surplus/(deficit) | (73,036) | (20,142) |

49 The table above shows that we are borrowing $20.142 million in the draft budgets to fund renewals. While this is not sustainable long-term, this will be addressed in a review of the Financial Strategy that will be prepared for the 9 year plan 2025-34.

Debt

50 The Draft Forecast Financial Statements at Attachment C shows that by 30 June 2025, the estimated debt level will be $706.528 million which is 188.6% of revenue. The debt limit provided for in the current Financial Strategy is 250% of revenue. This is an increase in debt of $117.554 million on the 2023/24 Annual Plan.

OPTIONS

51 There are no options.

Signatories

| Author: | Sharon Bodeker – Special Projects Manager Carolyn Allan – Chief Financial Officer |

| Authoriser: | Sandy Graham – Chief Executive Officer |

Future borrowing [already costing $1 million per week assuming 5.2% interest] for our BILLION$ DCC Group Debt is going to cost even more with a newly negative S&P Outlook rating.

Future budgets already planned show this debt increasing by ANOTHER HALF BILLION by 2027 as the DCC Finance graph below shows.

As the new Chair of Finance and Council Controlled Organisations last year I moved to get the word ‘sustainable’ added into two key places in the DCC Financial Policy, which Elected Representatives readily voted for.

Since then Council has continued to vote for unsustainable capital and operational spending at an unprecedented rate. Much of this increased spending has been on unproductive planet-saving transportation changes like cycleways and removing cars from the central City, along with CO2 monitoring and more compliance bureaucracy.

Another unbalanced budget looms ahead of us along with unprecedented rates rises as a result.

Borrowing outlook downgraded | Otago Daily Times Online News (odt.co.nz)

As I have been warning for several years already, the inevitable is upon us and is predicted to get steadily even worse this coming year, especially for those with high levels of debt.

The ANZ is predicting the Official Cash Rate that that drives higher interest rates to increase to 5.75% shortly and then again to 6% mid-year.

Brace yourselves

On 1 February ODT readers were advised that DCC had purchased most of the former Forbury Park. No definitive purpose for the land was disclosed. I consider the purchase to be provisionally worthwhile, given the land’s potential to be used for housing, perhaps with a water feature, or as a reconfigured wetland. My personal preference is irrelevant.

Mayor Radich, Taieri MP Leary and the writers of this paper’s editorial of 3 february have enthusiastically backed the purchase, seemingly believing that stormwater flooding akin to what happened in June 2015 can be reduced or eliminated by diverting stormwater to what might be in future called Lake Forbury. It would appear that neither Mr Radich nor Ms Leary has considered how stormwater from across greater South Dunedin could ever find a pathway to the “lake”. There are no waterways across the floodplain, and gravity drainage is non-existent; hence the pumped drainage system that was installed in the early 1960s. It would presumably be possible to replicate such a system of pipes and pumps to divert stormwater to the “lake”, but this would surely be massively less cost-efficient that upgrading the existing system that feeds directly into Otago Harbour.

The writers of ODT’s editorial have unfortunately circumvented these difficulties by erroneously reporting a typical scenario for flooding across South Dunedin that has simply never occurred – and could not. The editorial refers to flood waves caused by heavy rain running down the hills and cutting across South Dunedin to the harbour. These, it is stated, can be intercepted by Lake Forbury et al. The reality is that the vast majority of stormwater flooding across South Dunedin is caused by rainfall intensities falling directly across the suburb that exceed the system’s capacity (around 7mm/hr, from memory and according to my analyses) over a reasonably pronged period. Flooding simply increases in depth gradually until the rain eases sufficiently. Any input from the hills merely adds to the pond. There are no flood waves to be intercepted.

The other key issue that seems to have been overlooked is the toxic nature of urban stormwater in general, and in South Dunedin in particular. Just ask anyone whose home was flooded in 2015. While industrial pollution would create something of an issue, the far greater concern would be the concentration of untreated sewage that inevitably pollutes South Dunedin floodwaters. The last thing that an expensively constructed water feature would need would be to be polluted thus risking the health of all its users, human or otherwise.

In my view, residents of South Dunedin should not therefore hold out much hope that any variant of “Lake Forbury” will reduce their flood risk to any meaningful extent. Instead, they may question why – at the time of writing, exactly 8 years and 8 months to the day – no material improvements have been made to South Dunedin’s stormwater infrastructure following the disastrous flood event of 3-4 June 2015.

Neil Johnstone (semi-retired professional flood control engineer)

10 Tidewater Drive

Otago Peninsula

021 08728776

https://www.odt.co.nz/news/dunedin/dcc/complaint-laid-against-vandervis

https://www.odt.co.nz/news/dunedin/dcc/vandervis-complaint-second-attempt-censure

Letters to the Editor printed yesterday…

Vandervis complaint ‘pick on Lee time’

Here we go again, it’s pick on Cr Lee Vandervis time.

As someone who grew up bilingual and coming from a heritage where

there are three official languages I can claim to have some

understanding of the situation. What is happening now is not a

recognition and respect for Māori language but a confusing, mixed-up

version that is neither fish nor fowl.

Whether we like it or not the reality is that for the majority of

people living in New Zealand English is their first language and one

of the major languages of the world we live in. We should have

everything in both languages with English first, then repeated in

Māori, not (to use Lee’s words), a Māorified version of the whole

thing.

It sounds as though Cr Marie Laufiso is on a power trip. No-one should

be forced to actively participate in something they do not fully

understand the language of and may include elements they do not

believe in. All that should be required of councillors is respectful

attendance and to be forced to sing a waiata is totally unacceptable.

Sorry Cr Laufiso, but you are way out of line and totally exaggerating

your self-importance. We elect councillors to manage our city in this,

the 21st century, and while councillors have an obligation to have a

respect for the past, expecting them to spend a lot of time and energy

on matters of ceremony rather than the necessities is misguided.

S Hanson

Wakari

Faux offence

Another day, another character assassination attempt upon Lee

Vandervis promulgated by the ODT. But hey, the injury of

mispronouncing the word Māori must be severe, and refusing to face a

sham quasi-tribal inquisition, Te Pae Māori, which is another

senseless entity of imposing bureaucrats to bludgeon the rest of us,

is surely tantamount to heresy.

Having direct takata-whenua links with Otākou, Karitane and Maranuku,

I find the whole charade of ethnic tokenism acted out by local

government to be needless, if not cringeworthy. Yet Marie Laufiso, who

is not takata-whenua, spends her time screaming at the sky, pretending

to be offended on the behalf of Māori, instead of allowing others and

herself to get on the job they were elected to do in the first place.

Irian Scott

Port Chalmers

Waste of money

It is extraordinary that Dunedin ratepayers money is being wasted on

such matters. It is reminiscent of school days, where someone said

something you didn’t like, you might have replied “I’m going to tell

on you”, knowing the complainant would be believed and the alleged

offender told to improve his/her behaviour, regardless of the rights

or wrongs involved.

I trust ratepayers are taking note of the councillors who initiate

such undoubtedly expensive and certainly divisive complaints. Dunedin

does not need them as councillors.

The worst aspect is that the complaint will undoubtedly be upheld, and

after spending thousands of dollars on the matter the independent

investigator will be considerably wealthier, their client the DCC will

be pleased, and the ratepayers will be considerably worse off.

I knew Cr Vandervis over 30 years ago and liked him for being not only

forthright but also having an excellent business brain. I doubt that

has changed in the intervening years. What will have changed is the

DCC codes will have been honed to ensure that being forthright,

businesslike, or objective is totally unacceptable.

How could the mispronunciation of a word , or failure to sing at a

business meeting, be unacceptable behaviour?

I would suggest that if the investigator rules in favour of the

complainant as expected, that the DCC immediately resolve to decide on

a better method of resolving councillor disputes, that does not cost

the ratepayers a fortune to satisfy bruised egos, which is

businesslike, objective, and cost effective

K Lawson

Oamaru

[Abridged — length]

More Letters…

https://www.odt.co.nz/opinion/letters-editor-convenience-compliance-and-consent

Sing a song — or not

I have never been able to sing. I remember well the groans of my

teachers and classmates when I tried. But I would hate to be called a

racist, therefore I have some sympathy for Cr Vandervis and wish him

well in his endeavours.

Fay Lambert

Wānaka

Glad tidings

Roll on 2024 I say. My faith in mankind and commonsense is being

gradually restored after reading today’s front page of the ODT

(8.1.24). Having answered my query from a previous Letter to the

Editor printed last year where I questioned the cost relating to the

University of Otago’s sculpture that was unveiled (amidst all the doom

and gloom being reported of their failing financial position and

demise of courses along with academic personnel), I was heartened to

read today the ODT had its own questions relating to the same and went

a step further under the Official Information Act — bravo. Further in

the paper there were three letters to the editor backing Cr Lee

Vandervis — commonsense does prevail. I applaud the writers and their

reasoning and agree wholeheartedly. A great start to my day.

Joyce Yee-Murdoch

Cromwell

22/01/24

A nonsense

Duane Donavan (ODT, 11.1.24) correctly calls Cr Laufiso’s personal campaign against CR Vandervis “vexatious and a waste of council time.” or, as an earlier correspondent put it, “spending her time screaming at the sky, pretending to be offended on behalf of Māori.”

There are bigger things for the councillor to be concerned about. The continual loss of parking in the central city is just one example. George St, the one-time “golden mile” is no longer golden. Fed-up shoppers are going elsewhere, leaving struggling businesses in their wake; some even closing up.

Then there are ever-increasing rates, a real worry for those on fixed incomes. They won’t be impressed at their dollars being splashed out on an investigator following up Cr Laufiso’s complaint. A nonsense if ever there was.

G R MacDonald

Dunedin

https://www.bbc.com/news/world-asia-china-67818872

Beijing shivers through coldest December on record…

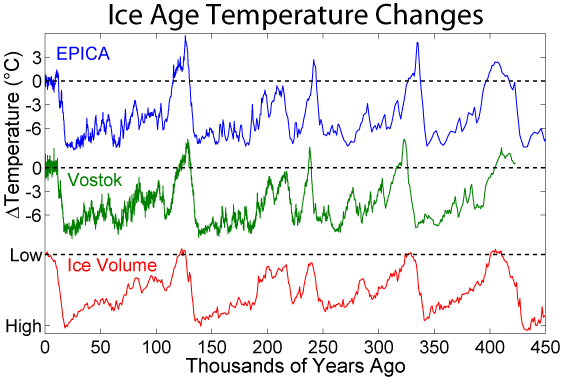

Perhaps global climate history is due to repeat?