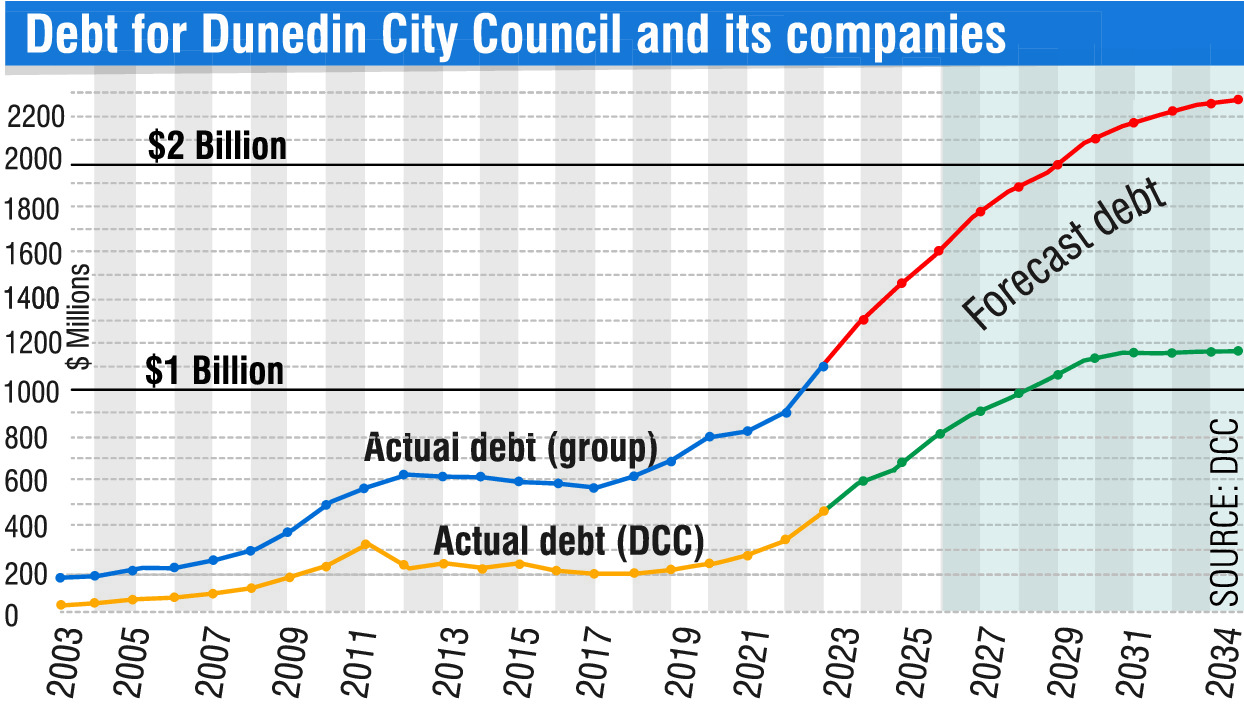

“The mayor’s suggestion “core” council debt would drop after five years was presented in council material as DCC debt excluding water, and this metric shows projected decreases from 2030.

Cr Vandervis described this as a “future fantasy”.

Mr Radich described Cr Vandervis as “sceptical” after many years at the council.

“I believe we are on track for debt repayment,” the mayor said.

“Anyone can see that core council debt excluding water starts dropping after five years and total council debt flattens, hence my contention that debt growth is under control when the LTP is looked at as a whole.”

Mr Radich had quite a different reading of the situation in February, when he urged councillors to avoid adding to the rising council debt that had already been included in draft budgets.

“We have been on a skyrocket trajectory of ever-increasing debt levels,” he said at the time.

“That is not sustainable and we don’t have to stay there.”

In March, S&P Global Ratings downgraded the council’s credit rating.

The rating of the council and its financing arm, Dunedin City Treasury Ltd, dropped from AA to AA- and the outlook for both organisations remained negative.”

My Debt Solutions include: back to basics spending, getting our Port Chalmers and Harbourside land back from the ORC (worth near $30 million per year), no more ORC rates, run better buses, get commercial returns from our Council- owned companies, sell-off unused or low-returning DCC land, improve staff productivity with University collaboration and AI, reverse recent $100+ million zerocarbon/cycleway splurge, pause $92.4 million Brighton Landfill, and use local contractors to keep Dunedin dollars and jobs in Dunedin.