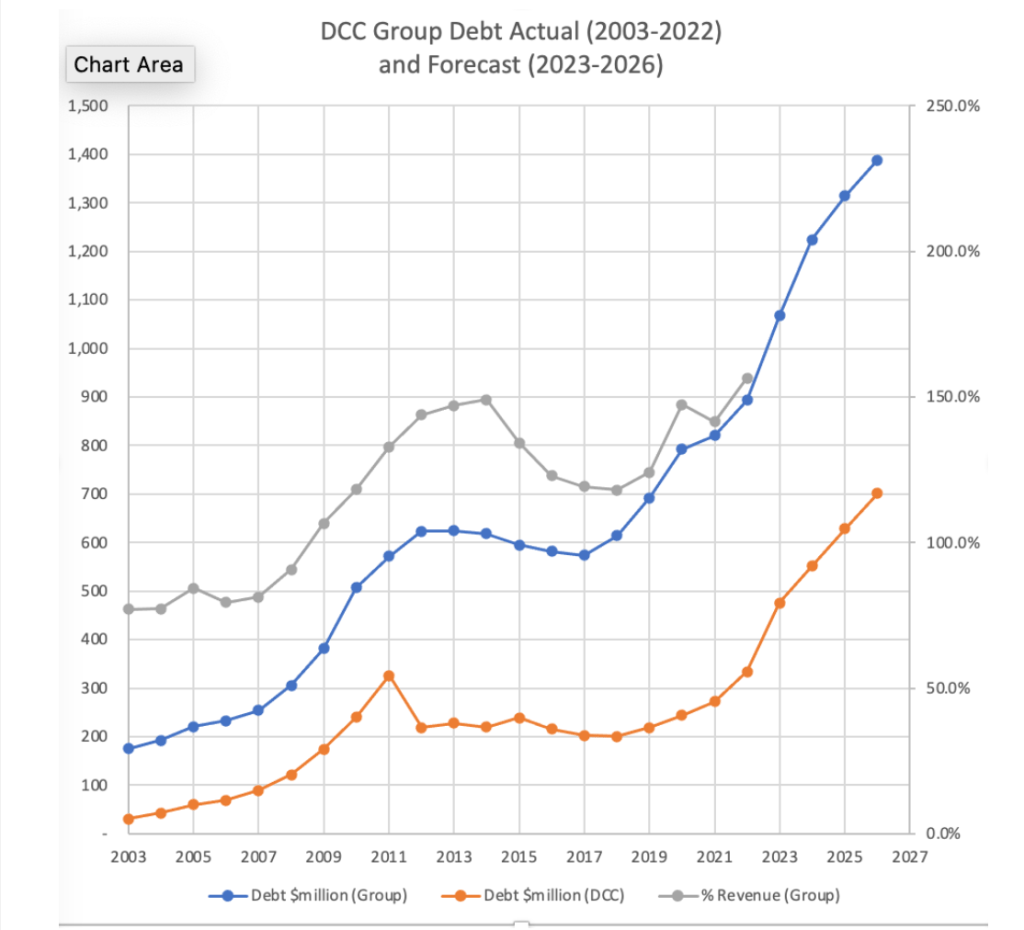

Future borrowing [already costing $1 million per week assuming 5.2% interest] for our BILLION$ DCC Group Debt is going to cost even more with a newly negative S&P Outlook rating.

Future budgets already planned show this debt increasing by ANOTHER HALF BILLION by 2027 as the DCC Finance graph below shows.

As the new Chair of Finance and Council Controlled Organisations last year I moved to get the word ‘sustainable’ added into two key places in the DCC Financial Policy, which Elected Representatives readily voted for.

Since then Council has continued to vote for unsustainable capital and operational spending at an unprecedented rate. Much of this increased spending has been on unproductive planet-saving transportation changes like cycleways and removing cars from the central City, along with CO2 monitoring and more compliance bureaucracy.

Another unbalanced budget looms ahead of us along with unprecedented rates rises as a result.

Borrowing outlook downgraded | Otago Daily Times Online News (odt.co.nz)

Thank you Lee for bring that to peoples attention, but this is total BS with the council continuing to spend so much money on so many levels.

Plain and blunt its how I am

The following comes to mind.

a. they spend but have no accountability leaving the Dunedin Rate payers holding the debit, they walk away feeling good – like they have done something.

b. The spend is it balanced?- is the world really improving just because some W#nkers on the DCC wants to feel good and spend loads of other peoples money and have no accountability ? When other countries / cities are doing nothing so does it make a difference?

c. Do they really have the peoples interests at heart? or are these W^nkers just drowning Dunedin in Debit for self promotion?

Do the council not have to adhere to a debt ceiling? or has that been departed with due to the scaremongering that the three waters proposal was?

The DCC has had many self-imposed debt ceilings which it has been progressively lifting since the Cull Council.

I have voted against all of these ‘more headroom’ motions which all very rapidly became ‘no more headroom’ realities.

This is a road to ruin, if the debt continues to increase and the already massive rates bills are not increased to service the debt, then we become insolvent. N